How to get cheap third party car insurance

One of the best ways to keep your premiums low is to build up a good no claims discount by driving carefully and safely over time. This can take a while though, of course, the longer the better, but the discounts you get are often very large.

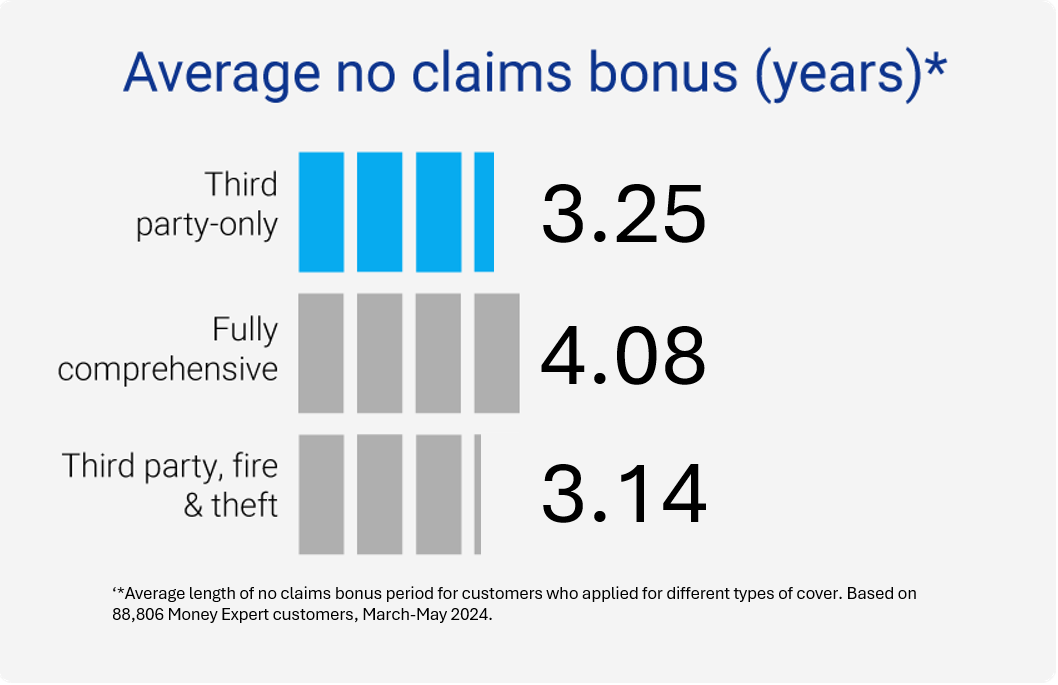

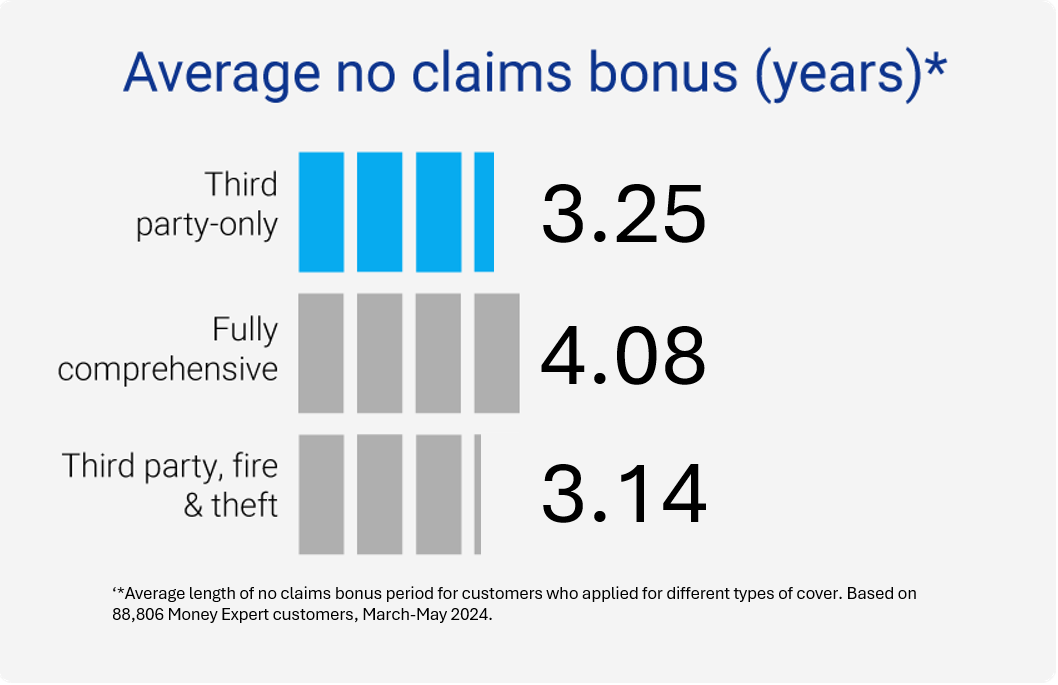

We found that customers applying for third-party only cover tended to have accrued less of a no claims bonus than customers applying for more comprehensive cover. This correlated with higher premium costs on average:

Third party-only: 3.25 years NCB average

Third party-only: 3.25 years NCB average

Fully comprehensive: 4.08 years NCB average

Third-party, fire and theft: 3.14 years NCB average

Whether or not you have a no claims discount built up, if you want to make sure you get the cheapest third party cover available, you'll need to shop around online. By using our third party car insurance comparison service, you can do just this with little effort and lots of rewards. Just let us know what kind of policy you're after, and we'll bring you up a list of the best car insurance quotes on the market that meet your requirements.

Other factors that can influence the cost of your third party car insurance are:

Third party-only: 3.25 years NCB average

Third party-only: 3.25 years NCB average